Configuring TouchBistro to Charge HST on Automatic Service Charges

Table Of Contents

Chapter 2. Using TouchBistro to Manage Service Charges

Chapter 3. Viewing the Tax on an Automatic Gratuities

Chapter 4. Eliminating Automatic Gratuity

Chapter 1. Introduction

It is common practice to add an automatic service charge for larger parties. For example, many restaurants automatically add an 18% service charge (also called an automatic gratuity or an “auto grat”). The Canada Revenue Agency (CRA) requires HST or GST to be collected on automatic service charges. To quote from the CRA’s guide:

A tip or gratuity that is freely given by a customer, for example, cash not recorded on a bill, is not subject to the GST/HST. However, if you add a mandatory or a suggested amount to the customer’s bill as a service charge, you have to charge GST/HST on that amount.

In other words, if you present customers with a bill with a blank tip line and the customer is free to tip any amount, you do not have to charge GST or HST. However, if you charge an automatic gratuity, the CRA views this as a service for labor and no different from having to charge GST/HST on labor for a car repair.

Chapter 2. Using TouchBistro to Manage Service Charges

TouchBistro supports charging HST for automatic gratuities. To configure this:

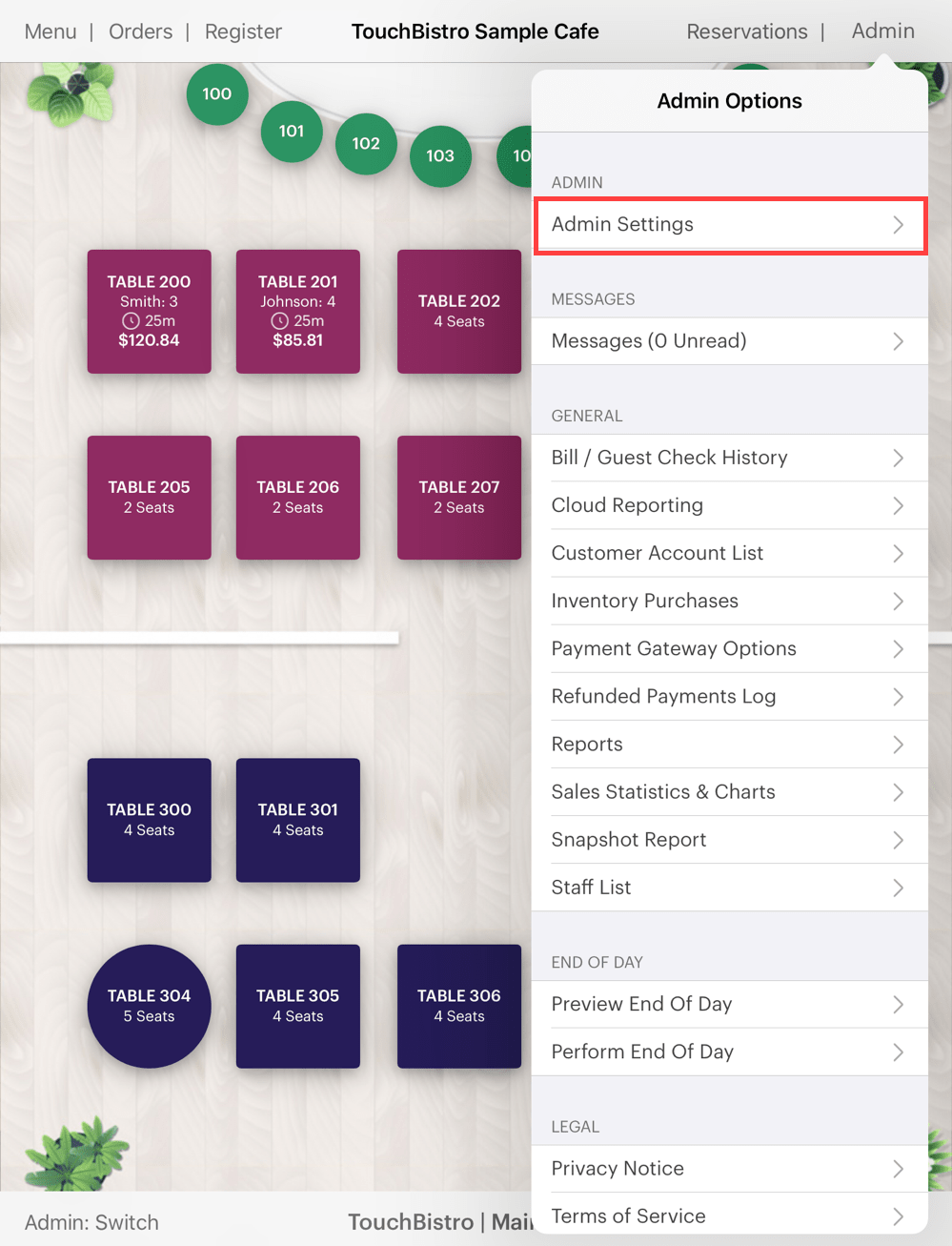

1. Log in using the admin code.

2. Tap Admin | Admin Settings in the top right hand corner.

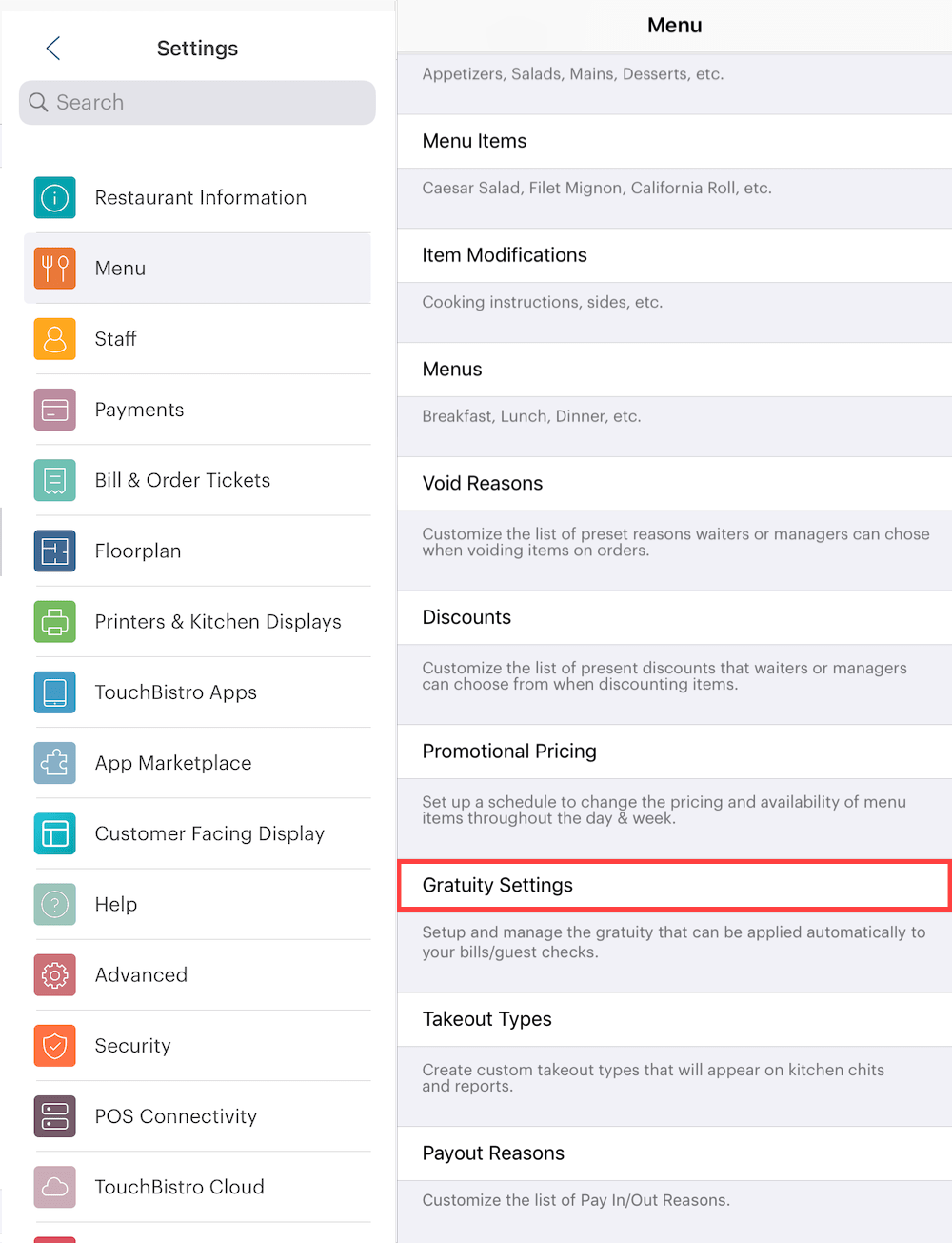

3. Tap Menu.

4. Tap Gratuity Settings. Review the settings for Add gratuity/service charge for parties greater than or equal to and Default Gratuity (%).

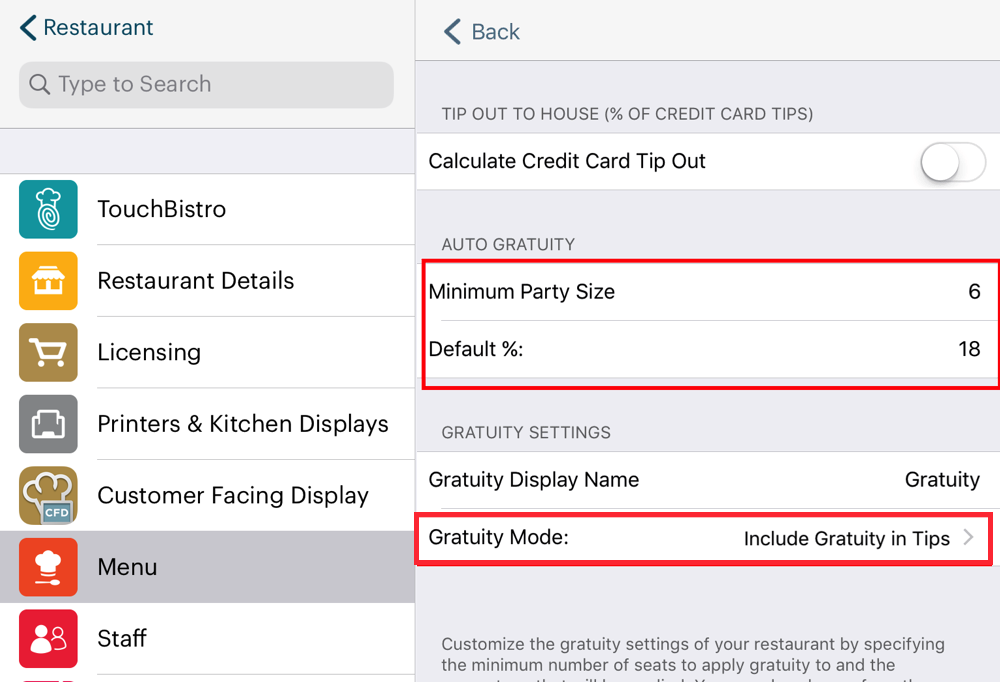

5. If you’ve set up TouchBistro to add an automatic gratuity percentage for parties greater than or equal to a certain size (for example 6) or you set an automatic service charge for parties of any size (i.e., one patron or more), TouchBistro allows you to separate out gratuities (i.e., automatic service charges) from tips (that is “payment made free from compulsion”).

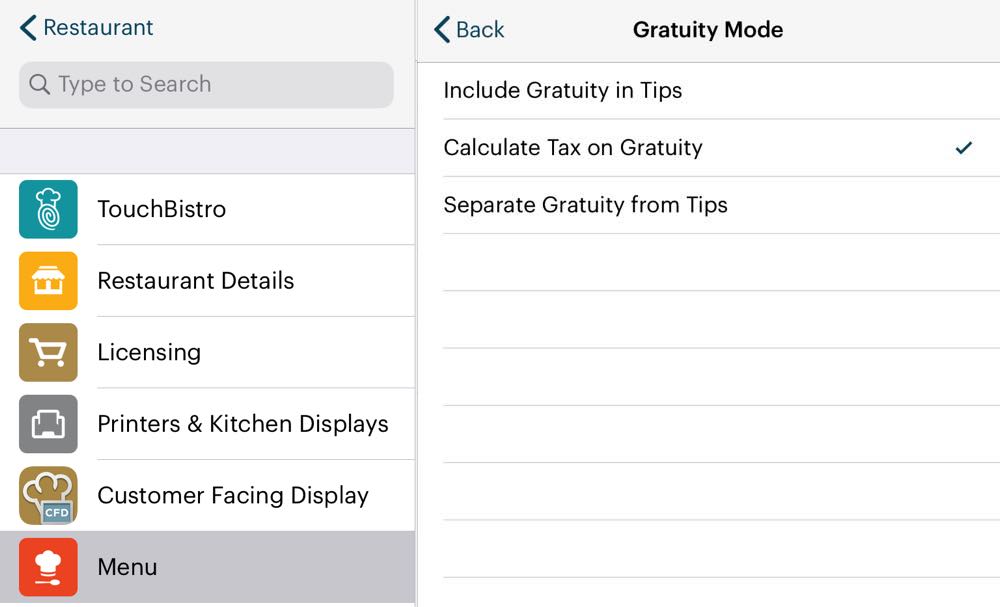

6. Tap Gratuity Mode.

7. Simply tap Calculate Tax on Gratuity.

Chapter 3. Viewing the Tax on an Automatic Gratuities

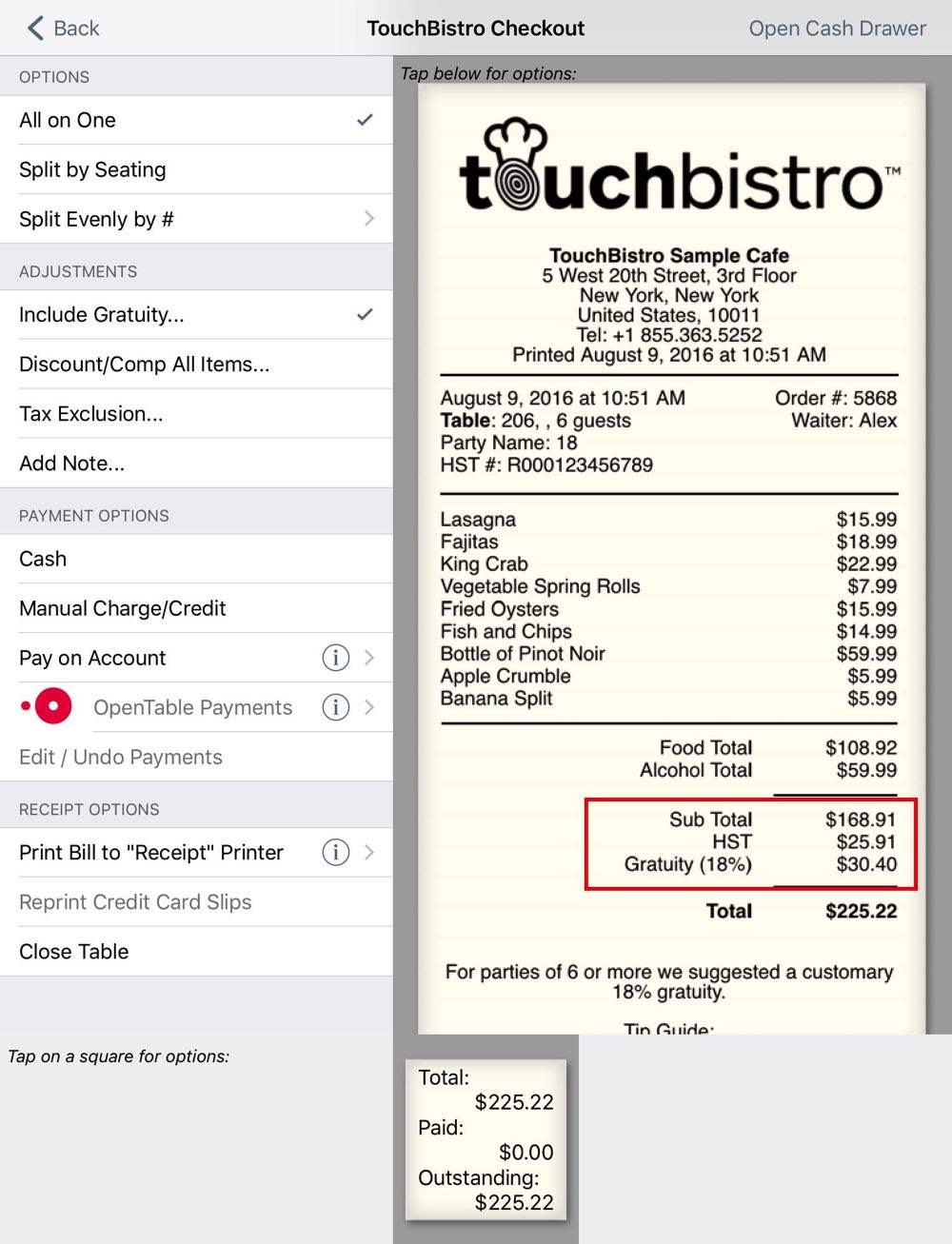

After setting Calculate Tax on Gratuity under Gratuity Mode, you can check the effect by returning to your floor plan, adding a table with a large party that will trigger an automatic gratuity. Add food items on the Order screen and tap Checkout. You will note the HST line calculates for the Sub Total + Gratuity.

In the example above, the HST is 13% of the subtotal plus the gratuity ($168.91+$30.40). The HST is $25.91 ((Sub Total + Gratuity) * HST).

Chapter 4. Eliminating Automatic Gratuity

Many customers are unaware an automatic gratuity also comes with an HST addition. Although many customers may not notice the slight difference, some may. You may choose to eliminate the automatic gratuity if this becomes a customer service issue. Some venues favor suggested tip amounts (a “tip guide”) printed on bills along with a more prominent suggestion that it is customary for larger parties to tip 18%.

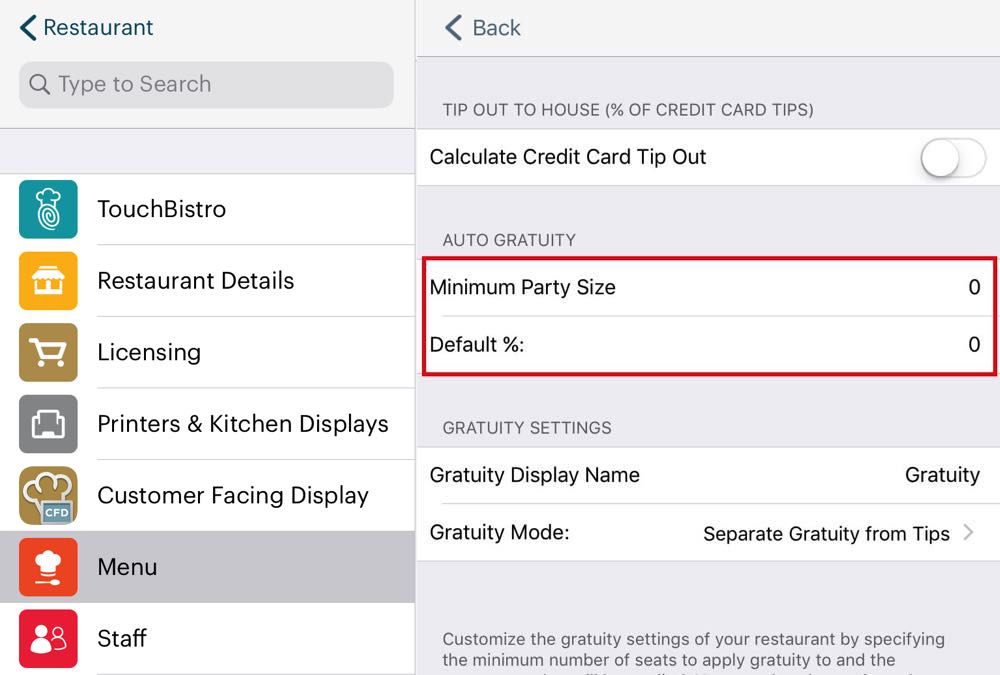

If you have set up an automatic gratuity and now wish to eliminate the automatic gratuity, set Minimum Party Size to 0 and Default% to 0.

Chapter 5. Setting a CRA Compliant Tip Guide

As the CRA guide notes a “tip or gratuity that is freely given by a customer… is not subject to the GST/HST”. Including a tip guide and a blank tip line is not a compulsory charge and allows the customer to give a tip freely.

TouchBistro allows the inclusion of a tip guide. To setup a tip guide or adjust it:

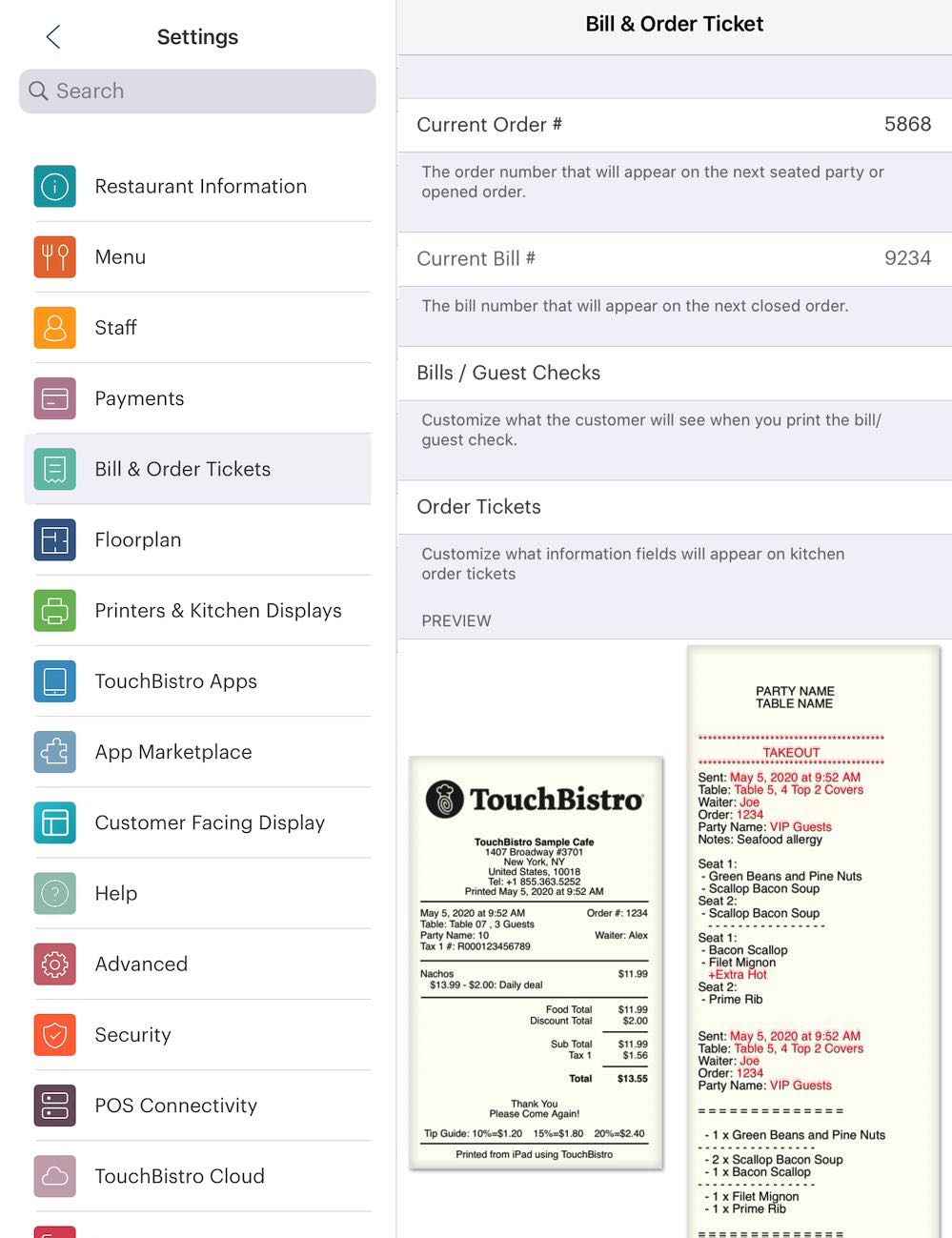

1. Tap Bill & Chit.

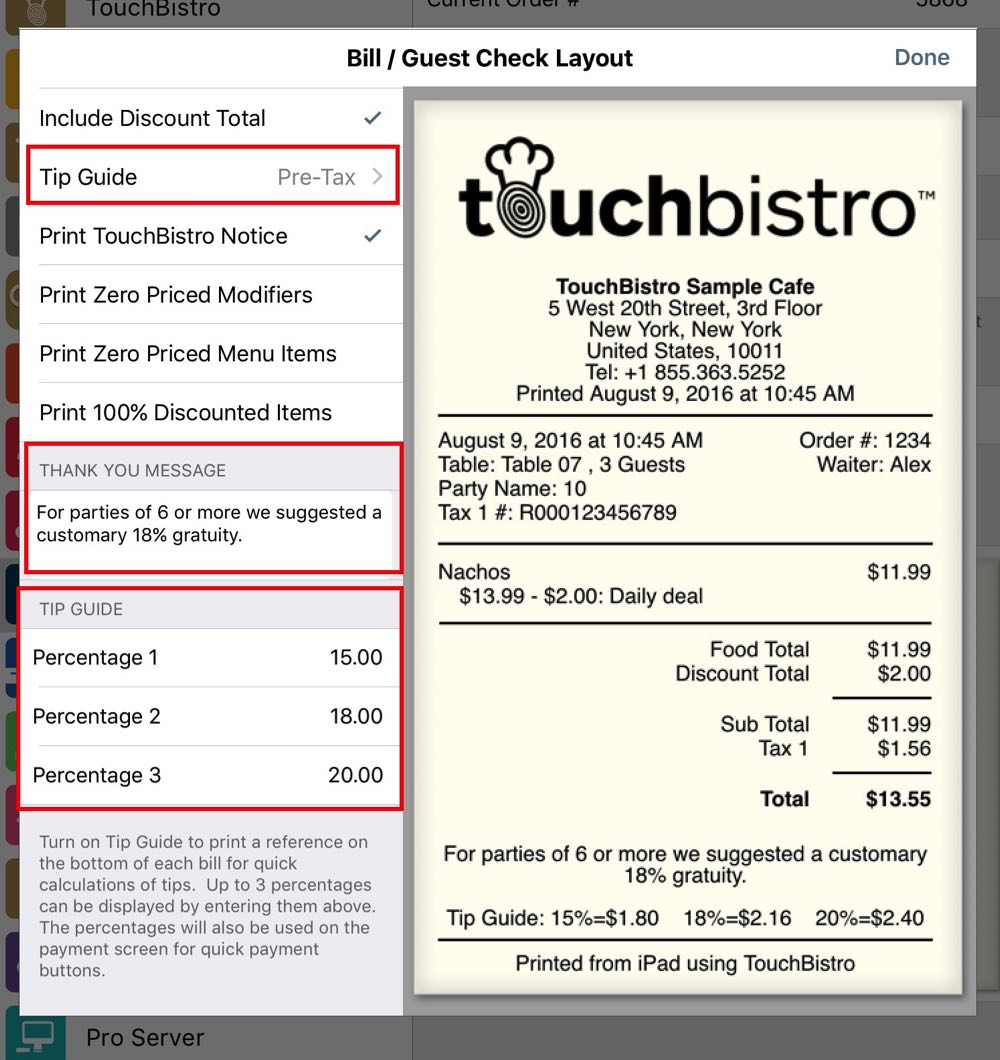

2. Tap Tip Guide and enable how you want your suggested tip amounts to calculate (before/after tax).

3. Enter three suggested tip percentages. If your default tips are 10%, 15%, and 20% and your previous automatic gratuity was 18%, you might want to adjust these to 15%, 18%, and 20%.

4. The Bill/Guest Check message area can also be reworded to suggest the appropriateness of an 18% gratuity for larger parties (say, 6 or more).

5. Ensure there’s a checkmark ![]() next to Include Tip Guide. It not, tap Include Tip Guide.

next to Include Tip Guide. It not, tap Include Tip Guide.

6. Tap Done.

6. Review how your Tip Guide and Bill/Guest Check message appear on your guest checks.

7. Double check on the Admin | Order & Credit Card Settings screen, Include Tipline on Credit Card Receipt is enabled. If you were charging all customers an automatic gratuity, you might have toggled this off.

Section 1. Note

This document and linked third party documents should not be construed as expert or official tax advice or how to adjust your business processes to comply with CRA requirements for collecting GST/HST. Please consult with your business’s tax expert or accountant before you make any changes.

Further Reading

Watch out for HST when mandatory tips are added to your bill

Email

Support

Email

Support Frequently

Asked Questions

Frequently

Asked Questions