Tax Settings

Video Tutorial

Step by Step Instructions

You should complete the Tax Settings screen before you start on your Menu Categories and Menu Items.

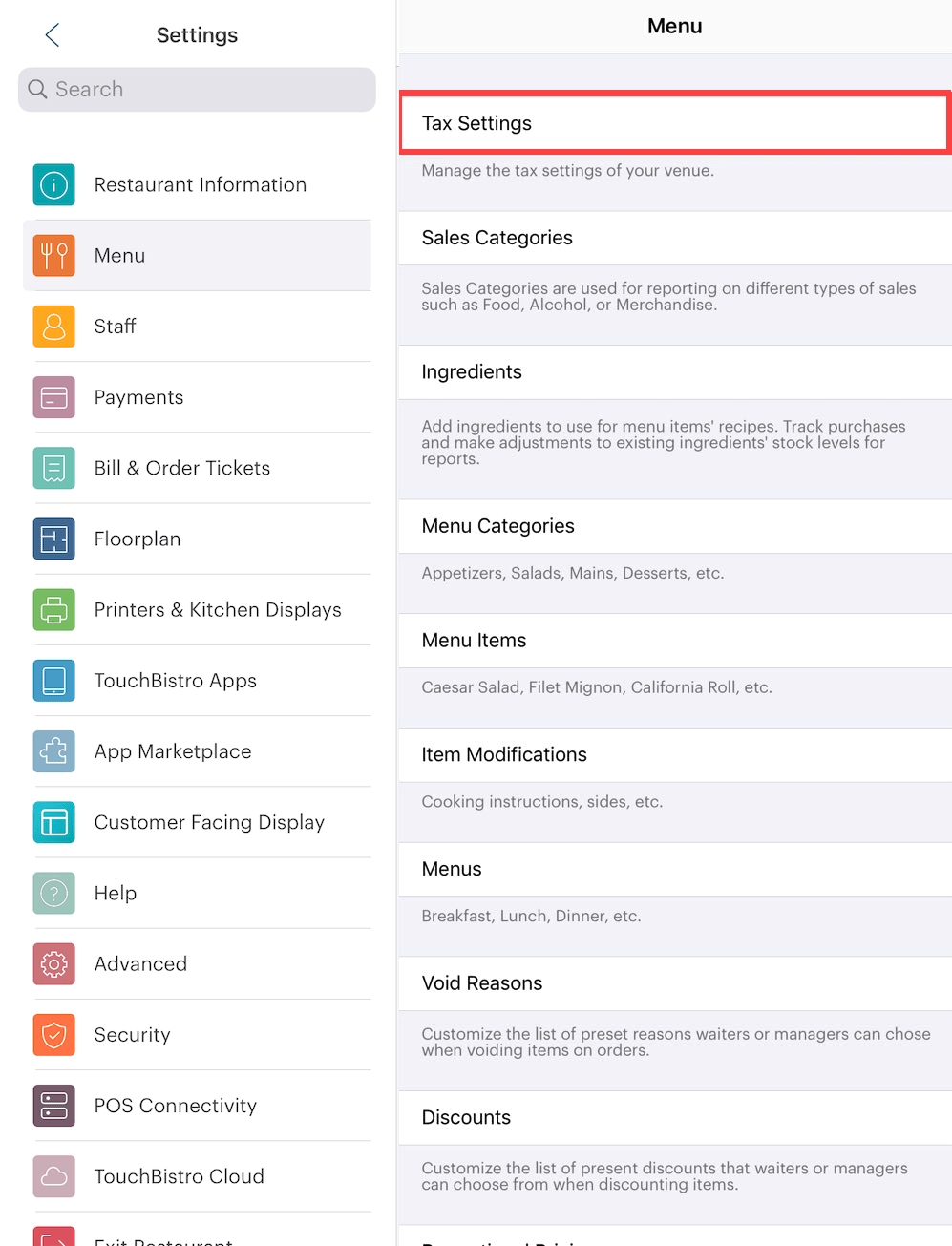

1. To setup tax details, tap Tax Settings.

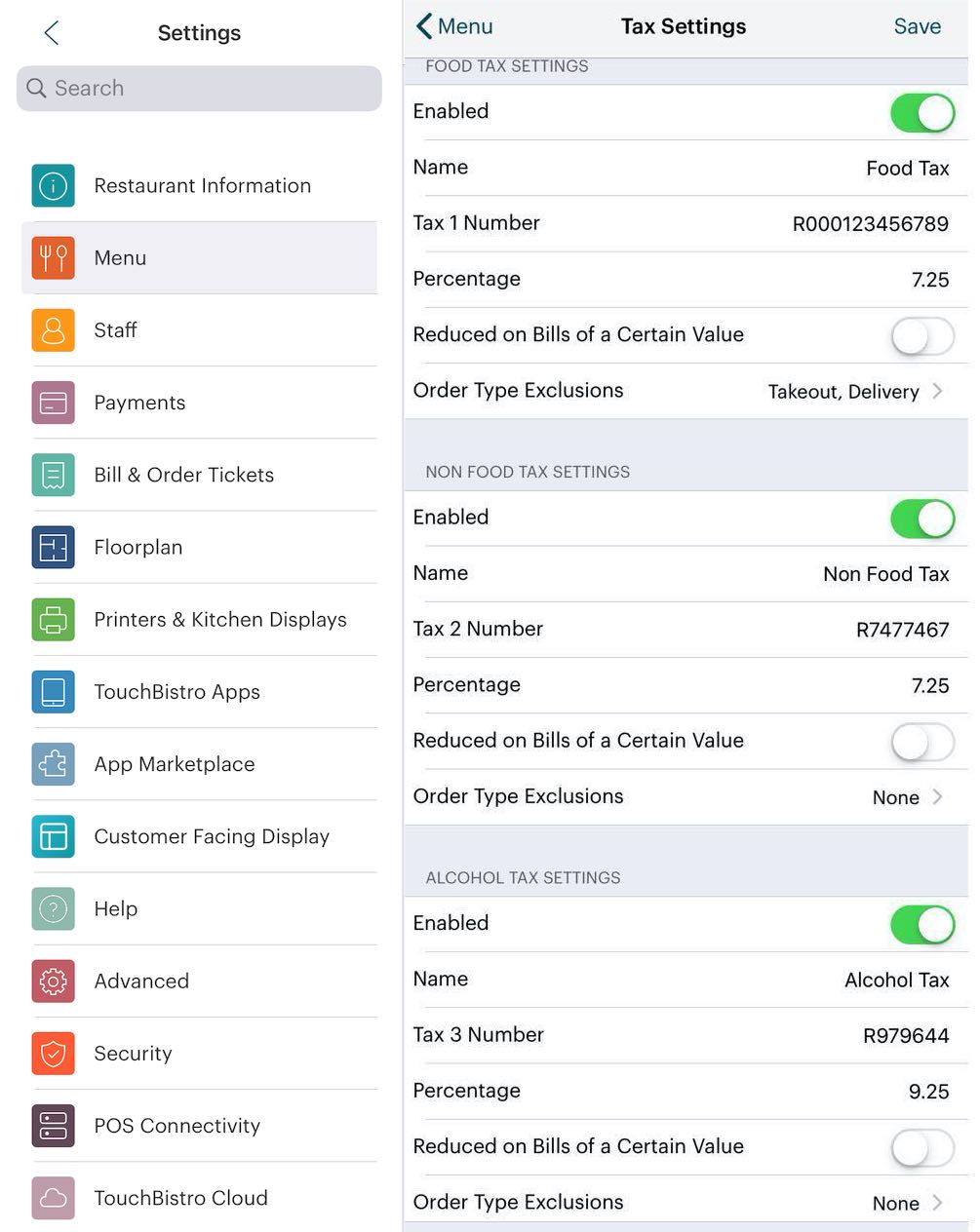

2. Enable taxes you need. For example, enable Tax 1. If you have to collect two taxes (a country/province tax or a state/city tax), enter the second tax in Tax 2. If you have to collect three taxes, enable Tax 2 and Tax 3.

3. Give each tax you have to collect a name in the Name fields. The text you enter in these fields will appear on the bill. Enter the rate in the Percentage field.

4. Some jurisdictions do not tax restaurant foods (or tax them at a lower rate) if they are under a certain pre-tax dollar value. Slide Reduced on Bills of a Certain Value to the green position to set up this exception.

For example:

Ontario levies a 13% HST (which comprises the old 5% GST and 8% PST) on restaurant bills. However, if the total bill is $4.00 or under, Ontario only charges the old GST. To set this up, you would create a 13% HST in Tax 1. In the Tax 1 reduction area, set tax 1 to 5% (the old GST rate) and set the when taxable amount on total is less than field to $4.01. So any bill between $0.01 and $4.00 will be taxed at 5%. A bill of $4.01 and over will be taxed at 13%. See this guide for full details.

5. If alcohol is billed at a special tax rate, you can use Tax 2 or Tax 3 for your alcohol tax. Name it “Alcohol Tax” and enter the rate. When you set up a menu category or menu item, you can specify this tax be applied to alcohol-related categories and menu items.

6. Enable Order Type Exclusions if the tax is not applicable for food ordered as take-out, delivery, and/or at the bar. Note: orders started on the register and transferred to a takeout or delivery order will not result in the tax being removed.

7. If your jurisdiction requires Tax 2 be calculated on the bill sub-total + Tax 1, slide Tax 2 on Tax 1 to the green position. The bill totally will then be (Sub-Total + Tax 1) x Tax 2. If disabled, Tax 1 will be calculated on the bill total. Tax 2 will be calculated on the bill sub-total. The bill totally will then be Sub-Total + Tax 1 + Tax 2. (Note, Quebec eliminated this form of taxation January 1, 2013.) This option can be used if an occupation tax has to be levied before the application of state/city/county taxes.

8. The Tax ID Number field cannot be blank. By default we “stub” in a Tax ID Number. If you’re not required to display a tax ID number, disable this on the guest check customization screen. Some jurisdictions require a tax ID number to be printed on guest checks so customers can claim tax paid for their business or personal taxes.

9. If you prefer to display menu prices with the tax, slide Inclusive Tax to the green position. The receipt will still break out the tax if this is enabled. If you’ve added Menu Items with prices before enabling this, TouchBistro will recalculate your menu item prices with the inclusive tax. If you want your menu to include taxes, see this discussion.

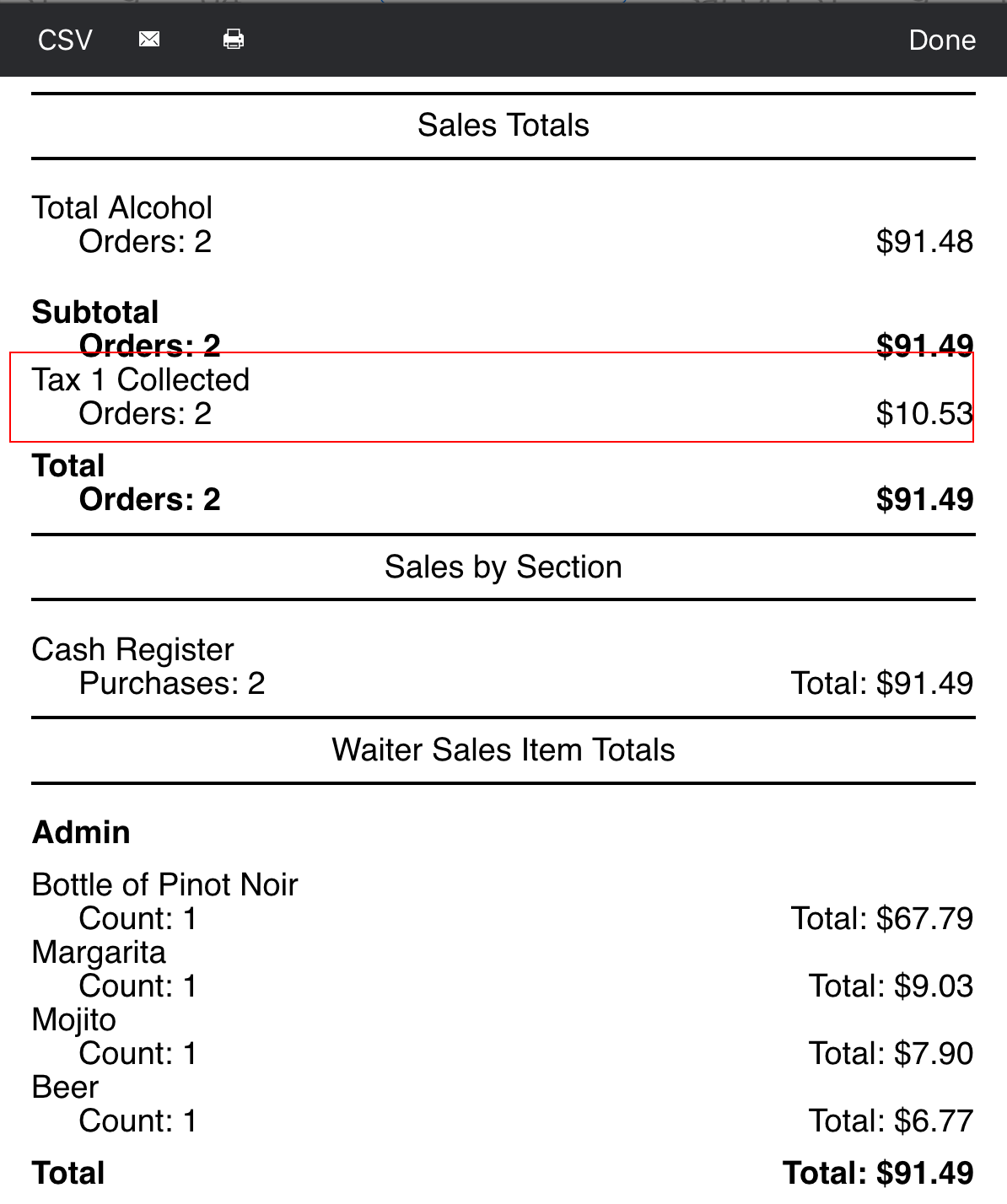

10. If you have enabled Inclusive Tax and would like your reports to work with the tax included into sales totals, enable Inclusive Tax for Reports.

Even if enabled, TouchBistro will still break out taxes for your Sales Totals report and appropriate tax reports. In the example above, the Sales Totals report breaks out the tax. However reports you may use to judge certain metrics, like Sales by Section or Waiter Sales Item Totals, TouchBistro won’t calculate a before-tax subtotal. TouchBistro will simply work with totals with tax included.

11 Tap Done when you’ve completed your tax settings and return to the Orders & Credit Card Settings screen.

Email

Support

Email

Support Frequently

Asked Questions

Frequently

Asked Questions